Hagerty/Collector Car Insurance??

#41

Staging Lane

Join Date: Feb 2007

Location: Chicago, IL

Posts: 75

Likes: 0

Received 0 Likes

on

0 Posts

Umm… just to clarify, and I’m not being a smart-***. You only have to pay $250 a year for your coverage, and if you crash your car or someone crashes into you… and it’s totaled… Grundy is going to cut you a check for $15,000 ???

#42

TECH Apprentice

Rates depend on age, marital status, driving record, credit history, accident rate in your community, plus a number of other variables.

#43

#44

LS1Tech Administrator

iTrader: (3)

Join Date: Nov 2001

Location: Schiller Park, IL Member: #317

Posts: 32,254

Likes: 0

Received 1,688 Likes

on

1,209 Posts

I disagree with your disagreement.

You seem to make a lot of assumptions but don't seem to have much experiance with collector type policies.

On my collector policy, I pay $30/year for liability, and that's for $100k of coverage against property damage or bodily injury. The remainder of my $493 annual premium is for comp and collision on BOTH my '98 Z ($20k agreed value) and '71 Nova ($25k agreed value). The reason liability is cheap for collector type policies is because they are very specific about use for, "exhibitions, parades, club activities, or other functions of public interest", and "is not to be used for regular driving to work, school, errands, shopping, general transportation, secondary or back-up transportation, busniess or commercial purposes; except for limited pleasure use". That is a direct quote from the useage endorsement section of my contract.

With such limited expected (and covered) use, the chances of an accident resulting in damage to another party's property are slim. The greater risk is damage to the car itself from fire, vandalism, etc., or of course theft of the vehicle. So comp & collision coverage are at greater cost.

As these types of policies are not usually available to high risk drivers (based on age and/or driving record), there shouldn't be a huge variance in liability cost (of course that depends on your definition of "huge"). I don't know what $300k of coverage would cost me, but even if it was 5 times as much (doubt it would be), that's still only $120 more per year..... not huge IMO.

Furthermore, looking at the declarations page for my "daily driver" insurance on my '02 Z (State Farm), I pay slightly more for comp & collision than liability on that car as well. This is a normal everyday type policy. So to say that liability is always the most expensive part isn't accurate.

Originally Posted by ZigZagZ

The most expensive portion of any auto policy is liability coverage.

On my collector policy, I pay $30/year for liability, and that's for $100k of coverage against property damage or bodily injury. The remainder of my $493 annual premium is for comp and collision on BOTH my '98 Z ($20k agreed value) and '71 Nova ($25k agreed value). The reason liability is cheap for collector type policies is because they are very specific about use for, "exhibitions, parades, club activities, or other functions of public interest", and "is not to be used for regular driving to work, school, errands, shopping, general transportation, secondary or back-up transportation, busniess or commercial purposes; except for limited pleasure use". That is a direct quote from the useage endorsement section of my contract.

With such limited expected (and covered) use, the chances of an accident resulting in damage to another party's property are slim. The greater risk is damage to the car itself from fire, vandalism, etc., or of course theft of the vehicle. So comp & collision coverage are at greater cost.

As these types of policies are not usually available to high risk drivers (based on age and/or driving record), there shouldn't be a huge variance in liability cost (of course that depends on your definition of "huge"). I don't know what $300k of coverage would cost me, but even if it was 5 times as much (doubt it would be), that's still only $120 more per year..... not huge IMO.

Furthermore, looking at the declarations page for my "daily driver" insurance on my '02 Z (State Farm), I pay slightly more for comp & collision than liability on that car as well. This is a normal everyday type policy. So to say that liability is always the most expensive part isn't accurate.

#45

TECH Apprentice

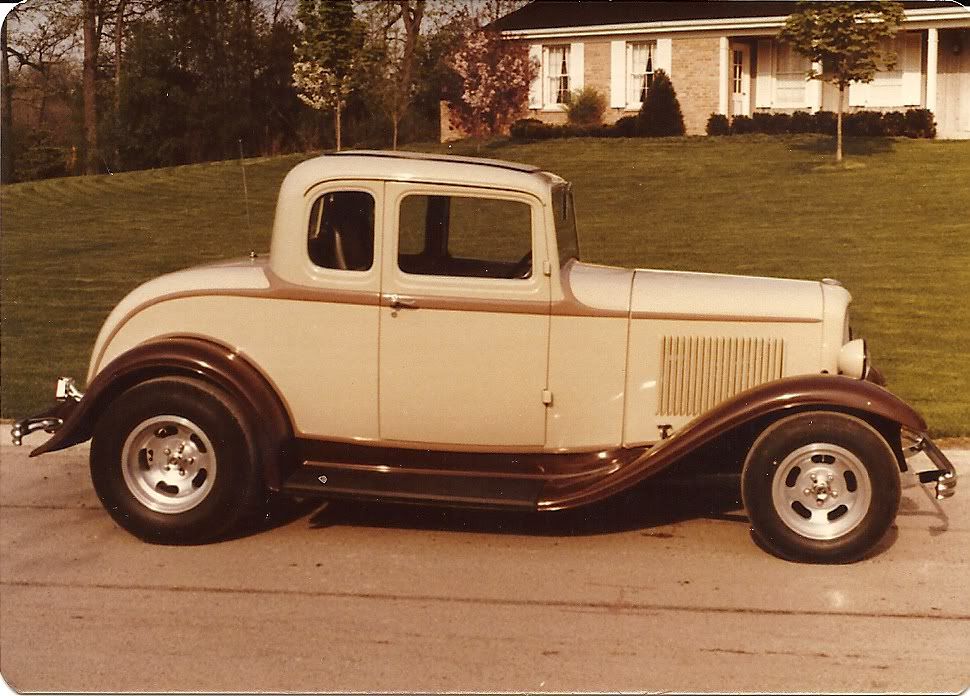

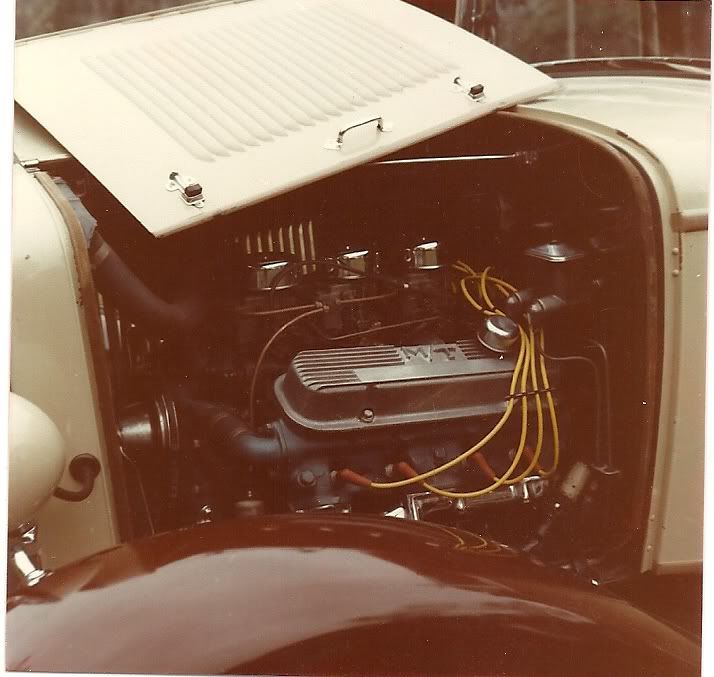

Friendly FYI: I have had 2 collector car policies over the years. The first one was for a ’32 Ford 5-window coupe that I owned for 7-years (beautiful steel car, not a glass replica), and the other was for a 69 Shelby GT-350 that I had for 13-years. Neither of those cars had a NADA book value, so they were appraised at an agreed value with my insurance company. The underwriter of both policies was the Hartford Insurance Co.

My policies differed from yours in a number of ways. I could drive my car at anytime, and anywhere I wanted to go, but I had a limit of 2,500 miles per year. If I wanted to buzz to the office, or if I wanted to pick up my daughter at school I was covered. My policies “stood alone", and did not require or mandate that I have a primary daily driver vehicle (with a separate insurance policy). In fact, there was a time when the '69 Shelby was my only car. I lived in an urban area, and effectively utilized public transportation for my day to day commuting needs.

Regarding your $30.00 liability policy, I would venture to say that it is part of a “package” deal with your other coverages. You probably couldn’t buy the $100k of liability coverage by itself, for 30 bucks a year. The cost associated with underwriting, and administering such a liability policy is much greater. Given that your policy is a package of coverages, and given that it requires you to have a primary vehicle (with insurance) your true cost of liability coverage is a lot more than $30.00 per year.

Please do not misunderstand me, I am not saying my policies were better, nor am I saying that your policies are crap. Quite to the contrary, if Grundy suits your needs, risks, and driving style than I am truly happy for you (I really am!).

Peace

#46

LS1Tech Administrator

iTrader: (3)

Join Date: Nov 2001

Location: Schiller Park, IL Member: #317

Posts: 32,254

Likes: 0

Received 1,688 Likes

on

1,209 Posts

My policies “stood alone", and did not require or mandate that I have a primary daily driver vehicle (with a separate insurance policy). In fact, there was a time when the '69 Shelby was my only car. I lived in an urban area, and effectively utilized public transportation for my day to day commuting needs.

Regarding your $30.00 liability policy, I would venture to say that it is part of a “package” deal with your other coverages. You probably couldn’t buy the $100k of liability coverage by itself, for 30 bucks a year. The cost associated with underwriting, and administering such a liability policy is much greater. Given that your policy is a package of coverages, and given that it requires you to have a primary vehicle (with insurance) your true cost of liability coverage is a lot more than $30.00 per year.

It costs me $288 per year for the same level of liability coverage for my daily driver with State Farm. However, comp & collision cost me $338 per year for the same car on that policy. I'm actually not sure if I've ever had an auto insurance policy where the liability coverage was more expensive than C&C. Then again, I've never carried a $500k level of coverage like you, and I highly doubt I ever would.

You get some people that call their car a "show/collector" car because they store it in the winter, but still want to drive it every day in the spring/summer/fall no matter where they're going. This is not a true show/collector car. I think that's where many people get lost on the qualifications and their personal expectations of a policy.

For someone like me, my '71 and '98 only come out for an occasional pleasure drive and to the local Friday/Saturday/Sunday cruise spots on the most perfect weather days. This comes to a grand total of about 1,000 to 1,500 miles per year for each car. For such limited mileage, it would be a watse to pay for a normal level of liability coverage.

Last edited by RPM WS6; 03-25-2010 at 10:45 PM.

#47

TECH Fanatic

iTrader: (2)

Im really going to look into the Hagerty insurance...this is exactly what I need. I dont drive the car 3k a year and not just anywhere...and if theres ANY chance or rain, forget about it haha.

Ive been thinking about insurance lately to help save me some money but wasnt sure which way to go, good thread!

Ive been thinking about insurance lately to help save me some money but wasnt sure which way to go, good thread!

#48

On The Tree

iTrader: (7)

Join Date: Jul 2006

Location: NOLA

Posts: 173

Likes: 0

Received 0 Likes

on

0 Posts

Your input is most valuable, and that’s what makes LS1Tech so great.

Friendly FYI: I have had 2 collector car policies over the years. The first one was for a ’32 Ford 5-window coupe that I owned for 7-years (beautiful steel car, not a glass replica), and the other was for a 69 Shelby GT-350 that I had for 13-years. Neither of those cars had a NADA book value, so they were appraised at an agreed value with my insurance company. The underwriter of both policies was the Hartford Insurance Co.

My policies differed from yours in a number of ways. I could drive my car at anytime, and anywhere I wanted to go, but I had a limit of 2,500 miles per year. If I wanted to buzz to the office, or if I wanted to pick up my daughter at school I was covered. My policies “stood alone", and did not require or mandate that I have a primary daily driver vehicle (with a separate insurance policy). In fact, there was a time when the '69 Shelby was my only car. I lived in an urban area, and effectively utilized public transportation for my day to day commuting needs.

Regarding your $30.00 liability policy, I would venture to say that it is part of a “package” deal with your other coverages. You probably couldn’t buy the $100k of liability coverage by itself, for 30 bucks a year. The cost associated with underwriting, and administering such a liability policy is much greater. Given that your policy is a package of coverages, and given that it requires you to have a primary vehicle (with insurance) your true cost of liability coverage is a lot more than $30.00 per year.

Please do not misunderstand me, I am not saying my policies were better, nor am I saying that your policies are crap. Quite to the contrary, if Grundy suits your needs, risks, and driving style than I am truly happy for you (I really am!).

Peace

Friendly FYI: I have had 2 collector car policies over the years. The first one was for a ’32 Ford 5-window coupe that I owned for 7-years (beautiful steel car, not a glass replica), and the other was for a 69 Shelby GT-350 that I had for 13-years. Neither of those cars had a NADA book value, so they were appraised at an agreed value with my insurance company. The underwriter of both policies was the Hartford Insurance Co.

My policies differed from yours in a number of ways. I could drive my car at anytime, and anywhere I wanted to go, but I had a limit of 2,500 miles per year. If I wanted to buzz to the office, or if I wanted to pick up my daughter at school I was covered. My policies “stood alone", and did not require or mandate that I have a primary daily driver vehicle (with a separate insurance policy). In fact, there was a time when the '69 Shelby was my only car. I lived in an urban area, and effectively utilized public transportation for my day to day commuting needs.

Regarding your $30.00 liability policy, I would venture to say that it is part of a “package” deal with your other coverages. You probably couldn’t buy the $100k of liability coverage by itself, for 30 bucks a year. The cost associated with underwriting, and administering such a liability policy is much greater. Given that your policy is a package of coverages, and given that it requires you to have a primary vehicle (with insurance) your true cost of liability coverage is a lot more than $30.00 per year.

Please do not misunderstand me, I am not saying my policies were better, nor am I saying that your policies are crap. Quite to the contrary, if Grundy suits your needs, risks, and driving style than I am truly happy for you (I really am!).

Peace

I've been lurking in this thread, and I know this is OT, but what color was the '32 Ford?

#49

12 Second Club

iTrader: (3)

Join Date: Aug 2005

Location: Old Bridge, NJ

Posts: 151

Likes: 0

Received 0 Likes

on

0 Posts

Very informative posts. But reading all these threads makes me cry. Jersey insurance is god awful expensive compared to everyone that posted in this thread lol. I pay 97 a month for just liability on my Trans am. If i add comprehensive and collision it goes up to 560 a month. That was the cheapest quote i got from over 30 insurance companies i spoke with. With a perfect driving record no accidents no tickets on record.

You lucky sobs

You lucky sobs

#50

12 Second Club

iTrader: (4)

I have Hagerty on my truck, with Hagerty the only thing Ive heard is you cant even whisper the word "nitrous" or they'll drop you immedialty.

I looked into Grundy, and they were definitely cheaper! But the fine print kept me from going with Grundy. I asked so many questions they had to ask their underwritters for answers. Yes, there is no mileage limits and they allow nitrous, but you cant drive to and from work. I like to take my truck to work on nice days, I still park it indoors even at work. You cant use it for any errands, so if I get in a wreck going up to the local pharmacy or auto parts store for something they could disclaim! The list went on, and I passed on Grundy.

I looked into Grundy, and they were definitely cheaper! But the fine print kept me from going with Grundy. I asked so many questions they had to ask their underwritters for answers. Yes, there is no mileage limits and they allow nitrous, but you cant drive to and from work. I like to take my truck to work on nice days, I still park it indoors even at work. You cant use it for any errands, so if I get in a wreck going up to the local pharmacy or auto parts store for something they could disclaim! The list went on, and I passed on Grundy.

#51

TECH Apprentice

#53

LS1Tech Administrator

iTrader: (3)

Join Date: Nov 2001

Location: Schiller Park, IL Member: #317

Posts: 32,254

Likes: 0

Received 1,688 Likes

on

1,209 Posts

But the fine print kept me from going with Grundy. I asked so many questions they had to ask their underwritters for answers. Yes, there is no mileage limits and they allow nitrous, but you cant drive to and from work. I like to take my truck to work on nice days, I still park it indoors even at work. You cant use it for any errands, so if I get in a wreck going up to the local pharmacy or auto parts store for something they could disclaim! The list went on, and I passed on Grundy.

But Hagerty is a good company as well, if for some reason I ever left Grundy I would only be interested in Hagerty as the replacement. The others I've read about just don't seem to suit my needs.

#54

The way you've stated (or understood) this is a bit misleading. The specific terms of the contrac are no *regular* use for commuting, errands, etc. Limited pleasure driving (to any destination) is allowed and covered by them, just like Hagerty. This is how it was explained to me by their staff, and this is exactly what's stated in my contract. Actually, after talking to both and looking at contract terms for both, there is very little difference in their terms, conditions, and expectations for storage and usage. Hagerty does not allow *regular* use to and from work, or as back-up general transportation either.

But Hagerty is a good company as well, if for some reason I ever left Grundy I would only be interested in Hagerty as the replacement. The others I've read about just don't seem to suit my needs.

But Hagerty is a good company as well, if for some reason I ever left Grundy I would only be interested in Hagerty as the replacement. The others I've read about just don't seem to suit my needs.

#55

TECH Junkie

iTrader: (2)

Join Date: May 2006

Location: somewhere that doesn't get snow

Posts: 3,455

Likes: 0

Received 3 Likes

on

3 Posts

I bit the bullet last week and put my car on American Collectors for $10k agreed value and 5k mi limits. I have been doing around 4k a year for the last couple years since moving back to indiana. like RPM WS6 my car doesn't come out in the rain unless i'm out in it and it rains which doesn't happen very often. I don't work right now but even when i did i never once drove my car for work purposes. It's only out for a drive on a nice day and mostly is driven to the local car cruise spots (although i sometimes do several a week) and once or twice a summer i'll take a long drive (85 mi each way) out to say lafayette, IN for a saturday Fbody get together or last year i drove 500 mi round trip to the trans am nationals. Both of these should still be allowed per the rules in my policy.

I'm paying $264 a year for $10k agreed value for the 5k mile policy.

I also changed my malibu from esurance to progressive so that saved me ~ $100 every 6 months. So i went from $466 every 6 months for both cars to $162 every 6 months for the malibu and $264 a year for the T/A.

I'm paying $264 a year for $10k agreed value for the 5k mile policy.

I also changed my malibu from esurance to progressive so that saved me ~ $100 every 6 months. So i went from $466 every 6 months for both cars to $162 every 6 months for the malibu and $264 a year for the T/A.

Last edited by 1995blacktattop; 03-30-2010 at 02:35 PM.

#57

I bit the bullet last week and put my car on American Collectors for $10k agreed value and 5k mi limits. I have been doing around 4k a year for the last couple years since moving back to indiana. like RPM WS6 my car doesn't come out in the rain unless i'm out in it and it rains which doesn't happen very often. I don't work right now but even when i did i never once drove my car for work purposes. It's only out for a drive on a nice day and mostly is driven to the local car cruise spots (although i sometimes do several a week) and once or twice a summer i'll take a long drive (85 mi each way) out to say lafayette, IN for a saturday Fbody get together or last year i drove 500 mi round trip to the trans am nationals. Both of these should still be allowed per the rules in my policy.

I'm paying $264 a year for $10k agreed value for the 5k mile policy.

I also changed my malibu from esurance to progressive so that saved me ~ $100 every 6 months. So i went from $466 every 6 months for both cars to $162 every 6 months for the malibu and $264 a year for the T/A.

I'm paying $264 a year for $10k agreed value for the 5k mile policy.

I also changed my malibu from esurance to progressive so that saved me ~ $100 every 6 months. So i went from $466 every 6 months for both cars to $162 every 6 months for the malibu and $264 a year for the T/A.

#58

Staging Lane

Join Date: May 2009

Location: BELLEVEGAS, IL

Posts: 79

Likes: 0

Received 0 Likes

on

0 Posts

I got a quote of $220 a year for my 99 SS with 30,000 miles and an argreed upon value of of $15,000. I am 28 single with no huge issues on my record and a garage to keep the car in. No milage restrictions and can be driven to work an average of once a week. I don't really know how they prove or figure that part of it, but I don't drive it to work anyway. I think the liability is $50,000. I only pay $400 with state farm for the same coverage, I was looking into it in order to be emission exempt in Illinois. I am a few years a way from needing it but I heard it is harder to get down the road on a car that has already passed a emissions test before. May daily is a 98 tahoe and it must be fully insured by another company. :EDIT: Forgot to mention my tahoe is fully insured with state farm for about $90 a month.

Last edited by BOONEY7750; 03-31-2010 at 03:12 AM. Reason: Forgot

#60

TECH Addict

iTrader: (57)

I have Grundy too, pay about $350/yr for $25k agreed coverage. My car sits 95% of the time in the garage.

FWIW: I think a lot of this conversation is "interpretive" which means if you ask three people, each will give their input on your coverage. Even the slaeman for the companies! Keep in mind Grundy and Hagerty both sub the insurance out to other companies, they are merely underwriters.

FWIW: I think a lot of this conversation is "interpretive" which means if you ask three people, each will give their input on your coverage. Even the slaeman for the companies! Keep in mind Grundy and Hagerty both sub the insurance out to other companies, they are merely underwriters.