State Farm will screw ya

#1

On The Tree

Thread Starter

Join Date: Jul 2010

Location: Midlothian, TX

Posts: 121

Likes: 0

Received 0 Likes

on

0 Posts

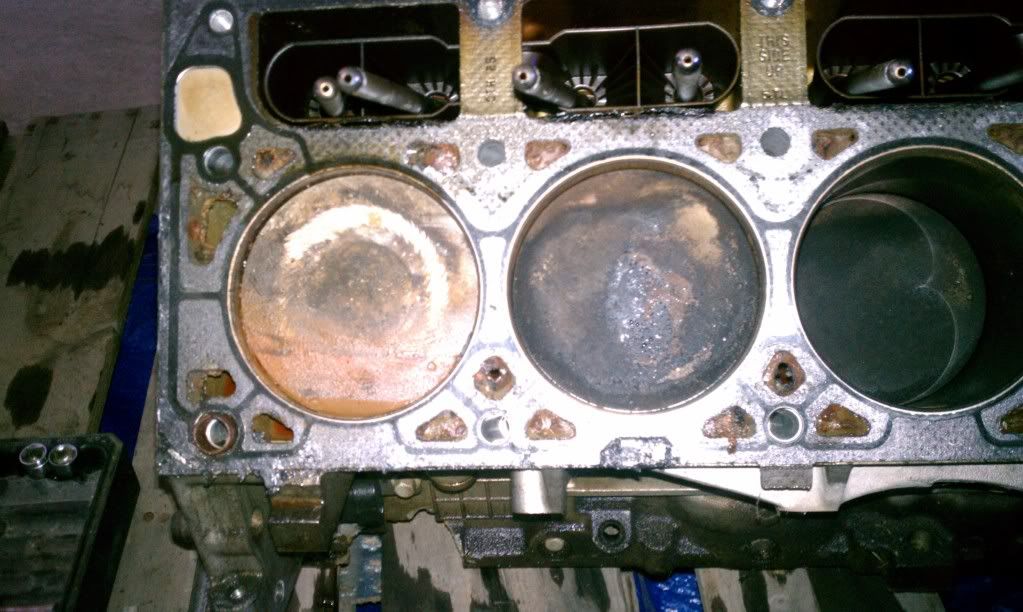

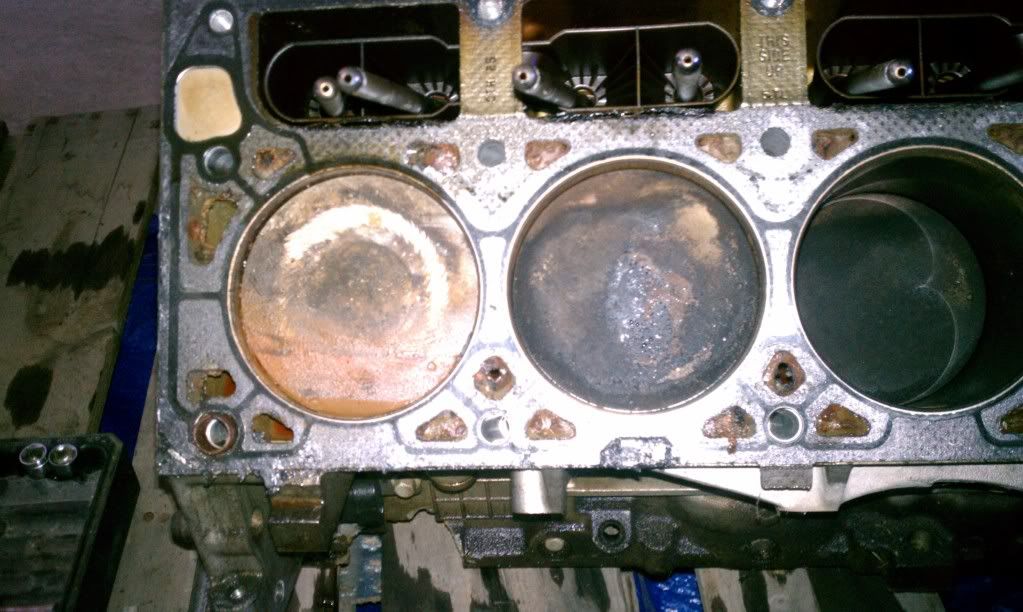

Heres some background: It rained hard about a month ago I sucked some water up in my engine and, boom, bend and threw a rod. State farm came out checked the oil and gave it a visual look over and said "there was no visible signs of water." Then my mechanic checked the intake manifold to find it had some water in it, state farm's response was "that normal condensation" Then I had a shop pull the oil pan and discovered the bent rod. Which could only be bent from water ingestion. Insurance called me again, only to have SF tell me that they could not find any signs of water in it. Well I bit the bullet and now have a shop installing a motor out of a 99 c5. I got the old "non-water damaged" motor home and guess what I found?

No water damage my ***

If you have State farm I would cancel with them. If you know a rep or are a rep reading this please get in touch with me. I would like to hear your theory of how some steel can rust without water being present.

No water damage my ***

If you have State farm I would cancel with them. If you know a rep or are a rep reading this please get in touch with me. I would like to hear your theory of how some steel can rust without water being present.

#3

TECH Fanatic

iTrader: (3)

Sorry about your issues! I think any insurance company depends on the Rep. I have state farm and they pulled my *** out of the fire when I was younger and stupid. It should have been really bad, but they took care of me. My dad was in a horrible predicament too, and they saved him as well.

Is it too late to show them that to see in you could maybe get reimbursed?

Is it too late to show them that to see in you could maybe get reimbursed?

Trending Topics

#8

TECH Addict

iTrader: (28)

Because you had a bad experience with state farm we should all drop them, uh no. Sounds like you didnt have the car at a reputable shop and they didnt show the correct things to the adjuster. I have dealt state farm for many years and you just have to know what to tell them. Sounds like you should blame your "mechanic".

#10

I don't care who you have for insurance. ANY adjusters decision would be the same based on the facts he was provided thus far, no water = $0.

Your issue is easily salvagable. Allow the original claims rep. an opportunity to re-inspect the damage. To really help yourself ask if he would like you to take it to a shop on their recommended list for a professional opinion on cause of damage.

Your mechanic should have done what a bodyshop would do in a water claim which is usually do nothing to vehicle until adjuster arrives. The adjuster will request inspection and teardown up to a limit. They will look for water in the most obvious places within the budget allowed for initial inspection. He will make determination. IF you don't agree with the decision thus far...you pay for additional teardown to provide conclusive evidence of water damage. Adjuster returns...Tada $'s for all fee's thus far and paid legitimate claim.

Imagine your $'s on the line everytime someone tells you their engine blew up because they accidentally "drove thru some water". Insurance isn't as simple as file a booboo claim = check. You have responsibilities just like the insurance company does. Its not you vs. them in a claim, its your situation vs. reality at the moment. They have to LEGALLY prove they paid your claim within the confines of the policy. Not because you're a longtime paying customer like the rest of us.

check. You have responsibilities just like the insurance company does. Its not you vs. them in a claim, its your situation vs. reality at the moment. They have to LEGALLY prove they paid your claim within the confines of the policy. Not because you're a longtime paying customer like the rest of us.

Your issue is easily salvagable. Allow the original claims rep. an opportunity to re-inspect the damage. To really help yourself ask if he would like you to take it to a shop on their recommended list for a professional opinion on cause of damage.

Your mechanic should have done what a bodyshop would do in a water claim which is usually do nothing to vehicle until adjuster arrives. The adjuster will request inspection and teardown up to a limit. They will look for water in the most obvious places within the budget allowed for initial inspection. He will make determination. IF you don't agree with the decision thus far...you pay for additional teardown to provide conclusive evidence of water damage. Adjuster returns...Tada $'s for all fee's thus far and paid legitimate claim.

Imagine your $'s on the line everytime someone tells you their engine blew up because they accidentally "drove thru some water". Insurance isn't as simple as file a booboo claim =

check. You have responsibilities just like the insurance company does. Its not you vs. them in a claim, its your situation vs. reality at the moment. They have to LEGALLY prove they paid your claim within the confines of the policy. Not because you're a longtime paying customer like the rest of us.

check. You have responsibilities just like the insurance company does. Its not you vs. them in a claim, its your situation vs. reality at the moment. They have to LEGALLY prove they paid your claim within the confines of the policy. Not because you're a longtime paying customer like the rest of us. Last edited by 2TR; 04-07-2011 at 08:57 PM.

#11

TECH Junkie

iTrader: (21)

Join Date: Oct 2003

Location: Houston , Tx

Posts: 3,419

Likes: 0

Received 0 Likes

on

0 Posts

I don't care who you have for insurance. ANY adjusters decision would be the same based on the facts he was provided thus far.

Your issue is easily salvagable. Only the original claims rep. or his supervisor can change the decision. Do not call the supervisor or things are gonna get slow real quick. People are human and they make mistakes. Be an adult and explain the situation as it is TODAY!

Technically the adjuster hasn't done anything wrong as his decisions have all been based on valid data, no water, no $'s. Your mechanic should have done what a bodyshop would do in a water claim which is usually do nothing to vehicle until adjuster arrives. The adjuster will request inspection and teardown up to a limit. They will look for water in the most obvious places within the budget allowed for initial inspection. He will make determination. IF you don't agree with the decision thus far...you pay for ADDITIONAL teardown to provide conclusive evidence of water damage. Adjuster returns...Tada $'s for all fee's thus far and paid legitimate claim.

Imagine your $'s on the line everytime someone tells you their engine blew up because they accidentally "drove thru some water". Insurance isn't as simple as file a booboo claim = check. You have responsibilities just like the insurance company does. Its not you vs. them in a claim, its your situation vs. reality at the moment. They have to LEGALLY prove they paid your claim within the confines of the policy. Not because you're a longtime paying customer like the rest of us.

check. You have responsibilities just like the insurance company does. Its not you vs. them in a claim, its your situation vs. reality at the moment. They have to LEGALLY prove they paid your claim within the confines of the policy. Not because you're a longtime paying customer like the rest of us.

Your issue is easily salvagable. Only the original claims rep. or his supervisor can change the decision. Do not call the supervisor or things are gonna get slow real quick. People are human and they make mistakes. Be an adult and explain the situation as it is TODAY!

Technically the adjuster hasn't done anything wrong as his decisions have all been based on valid data, no water, no $'s. Your mechanic should have done what a bodyshop would do in a water claim which is usually do nothing to vehicle until adjuster arrives. The adjuster will request inspection and teardown up to a limit. They will look for water in the most obvious places within the budget allowed for initial inspection. He will make determination. IF you don't agree with the decision thus far...you pay for ADDITIONAL teardown to provide conclusive evidence of water damage. Adjuster returns...Tada $'s for all fee's thus far and paid legitimate claim.

Imagine your $'s on the line everytime someone tells you their engine blew up because they accidentally "drove thru some water". Insurance isn't as simple as file a booboo claim =

check. You have responsibilities just like the insurance company does. Its not you vs. them in a claim, its your situation vs. reality at the moment. They have to LEGALLY prove they paid your claim within the confines of the policy. Not because you're a longtime paying customer like the rest of us.

check. You have responsibilities just like the insurance company does. Its not you vs. them in a claim, its your situation vs. reality at the moment. They have to LEGALLY prove they paid your claim within the confines of the policy. Not because you're a longtime paying customer like the rest of us.great feedback

#13

IF the agent wants to do some work for his customer (he should!) I would tell customer I'll get it taken care of. Give me a few moments to talk it over with the adjuster. Call adjuster. Ask about the existing facts. Describe your (customers) concerns and provide a short opinion of customers satisfaction in claim. INFORM him of the additional facts customer just provided. Request a re-inspection. Call you back looking like a hero when in reality I just used the phone to do what anyone else can do for themselves except I hope you understand your premium = "I work for you!".

Claims aren't rocket science but they are the purpose for paying someone else for advice/coverage, no? Rants, raves, and whining will get you to the same place they do anywhere else. Always consider though your original adjuster may or may not make the final decision but remember "someone" in the claims department is inevitably KING! The agent is a servent only to you in a claims decisions up to his pay grade...seller/advice giver/sometimes babysitter...nothing more. The agent answer to you...and claims answers to the legal binding policy agreement in representation of the company!

Last edited by 2TR; 04-07-2011 at 10:34 PM.

#14

I have had State farm for 30 years and they have always done me right on every claim that I have had and there have been quite a few. Depends on your adjuster and how your mechanic presented the facts.......There probably is a clause in your policy that if yall have a disagreement on a claim you can get arbitration to decide the issue. depends on your policy. If you show them you mean business and have your facts in order they can sometimes become more reasonable.

they can sometimes become more reasonable.

they can sometimes become more reasonable.

they can sometimes become more reasonable.

#16

TECH Addict

iTrader: (28)

Was the air filter wet? I am sure it was. This should have been shown to the adjuster. Once again, it's your mechanics fault. He didn't know how to present the damage to the adjuster. You are to blame also for not being forceful enough. You can't give in, threaten to drop them.

#18

10 Second Club

iTrader: (14)

I don't care who you have for insurance. ANY adjusters decision would be the same based on the facts he was provided thus far, no water = $0.

Your issue is easily salvagable. Allow the original claims rep. an opportunity to re-inspect the damage. To really help yourself ask if he would like you to take it to a shop on their recommended list for a professional opinion on cause of damage.

Your mechanic should have done what a bodyshop would do in a water claim which is usually do nothing to vehicle until adjuster arrives. The adjuster will request inspection and teardown up to a limit. They will look for water in the most obvious places within the budget allowed for initial inspection. He will make determination. IF you don't agree with the decision thus far...you pay for additional teardown to provide conclusive evidence of water damage. Adjuster returns...Tada $'s for all fee's thus far and paid legitimate claim.

Imagine your $'s on the line everytime someone tells you their engine blew up because they accidentally "drove thru some water". Insurance isn't as simple as file a booboo claim = check. You have responsibilities just like the insurance company does. Its not you vs. them in a claim, its your situation vs. reality at the moment. They have to LEGALLY prove they paid your claim within the confines of the policy. Not because you're a longtime paying customer like the rest of us.

check. You have responsibilities just like the insurance company does. Its not you vs. them in a claim, its your situation vs. reality at the moment. They have to LEGALLY prove they paid your claim within the confines of the policy. Not because you're a longtime paying customer like the rest of us.

Your issue is easily salvagable. Allow the original claims rep. an opportunity to re-inspect the damage. To really help yourself ask if he would like you to take it to a shop on their recommended list for a professional opinion on cause of damage.

Your mechanic should have done what a bodyshop would do in a water claim which is usually do nothing to vehicle until adjuster arrives. The adjuster will request inspection and teardown up to a limit. They will look for water in the most obvious places within the budget allowed for initial inspection. He will make determination. IF you don't agree with the decision thus far...you pay for additional teardown to provide conclusive evidence of water damage. Adjuster returns...Tada $'s for all fee's thus far and paid legitimate claim.

Imagine your $'s on the line everytime someone tells you their engine blew up because they accidentally "drove thru some water". Insurance isn't as simple as file a booboo claim =

check. You have responsibilities just like the insurance company does. Its not you vs. them in a claim, its your situation vs. reality at the moment. They have to LEGALLY prove they paid your claim within the confines of the policy. Not because you're a longtime paying customer like the rest of us.

check. You have responsibilities just like the insurance company does. Its not you vs. them in a claim, its your situation vs. reality at the moment. They have to LEGALLY prove they paid your claim within the confines of the policy. Not because you're a longtime paying customer like the rest of us.Not all agents play the claims violin the same. In this case you can't expect your agent to know what's going on if you don't inform him/her directly. He/she is not a claims junky looking to handle issues he/she can't honestly resolve to complete satisfaction alone anyhow. Most (including State Farm Agents) don't even have access to the claims ongoing records until after its resolved due to privacy. So they don't know what's happening unless they call you. Technically since they don't have access to the ongoing claims data they (State Farm) are trained to contact you thru out the claims process as a means of customer retention/satisfaction like Progressive/Geico/USAA/Ect. have done for years. Maybe your agent doesn't follow recommended corporate standards?

IF the agent wants to do some work for his customer (he should!) I would tell customer I'll get it taken care of. Give me a few moments to talk it over with the adjuster. Call adjuster. Ask about the existing facts. Describe your (customers) concerns and provide a short opinion of customers satisfaction in claim. INFORM him of the additional facts customer just provided. Request a re-inspection. Call you back looking like a hero when in reality I just used the phone to do what anyone else can do for themselves except I hope you understand your premium = "I work for you!".

Claims aren't rocket science but they are the purpose for paying someone else for advice/coverage, no? Rants, raves, and whining will get you to the same place they do anywhere else. Always consider though your original adjuster may or may not make the final decision but remember "someone" in the claims department is inevitably KING! The agent is a servent only to you in a claims decisions up to his pay grade...seller/advice giver/sometimes babysitter...nothing more. The agent answer to you...and claims answers to the legal binding policy agreement in representation of the company!

IF the agent wants to do some work for his customer (he should!) I would tell customer I'll get it taken care of. Give me a few moments to talk it over with the adjuster. Call adjuster. Ask about the existing facts. Describe your (customers) concerns and provide a short opinion of customers satisfaction in claim. INFORM him of the additional facts customer just provided. Request a re-inspection. Call you back looking like a hero when in reality I just used the phone to do what anyone else can do for themselves except I hope you understand your premium = "I work for you!".

Claims aren't rocket science but they are the purpose for paying someone else for advice/coverage, no? Rants, raves, and whining will get you to the same place they do anywhere else. Always consider though your original adjuster may or may not make the final decision but remember "someone" in the claims department is inevitably KING! The agent is a servent only to you in a claims decisions up to his pay grade...seller/advice giver/sometimes babysitter...nothing more. The agent answer to you...and claims answers to the legal binding policy agreement in representation of the company!

I think he said it all for you in his two post.

#19

10 Second Club

iTrader: (12)

Join Date: Jun 2005

Location: Arlington, Texas (Dallas Area)

Posts: 805

Likes: 0

Received 1 Like

on

1 Post

Because you had a bad experience with state farm we should all drop them, uh no. Sounds like you didnt have the car at a reputable shop and they didnt show the correct things to the adjuster. I have dealt state farm for many years and you just have to know what to tell them. Sounds like you should blame your "mechanic".

The car had to go through tear-down process first before any water damage could be detected. It was verified, #8 cylinder has obvious damage and also broke a rod in the process. The oil pan was also damaged. The adjuster had adequate time to look over all items and make a determination. The mechanic did inform the adjuster that the motor chunked a rod due to water damage, and that there was no evidence of high revving, racing, etc. All the poster needs to do is submit this new photo of evidence back to the Insurance company, corporate if possible for re-evaluation and a Claims Manager. The air filter was in fact dry due to the car sitting for a while.

The customer expressed his concern for needing the car up and running soon, and the authorization was given for the used motor install, regardless of what the Insurance was in the process of doing. The customer must deal directly with the Insurance company, as most repair/performance shops do not deal directly with 3rd party claims for payments, as body shops do.

Case closed: He just needs to submit the "water damage" evidence and explaination of what he sees to the Insurance Claims Manager.

Last edited by fasttagurl; 04-08-2011 at 10:13 AM. Reason: more facts

#20

10 Second Club

iTrader: (14)

You don't need to say this unless you know all the "facts". It's not a shops job or position to try to sway an Insurance company one way or another. You don't know what they did or didn't say to the adjuster. The shops job is to get the new motor in the car and assure that it runs properly.

Like a lot of people have said, if the picture with the rust in the engine would have been shown thats a good sign that water was the cause of the problem.

But this is just my .02

Last edited by SSHAWK; 04-08-2011 at 10:02 AM.